Mobility Products

Vehicle Adaptations

Choosing what you need

The range of adaptations available on the market is always improving. If you already use adaptations, are they still the best option available to you? Contact our team today for a no-obligation demonstration on any of our products before you change your vehicle.

If you have never used any adaptations, we are here to guide you through the process. Our expertise will help you find the correct solution for your requirements and we can even recommend the best cars to suit.

At Bewick Mobility, we offer an extensive range of vehicle adaptations and mobility products.

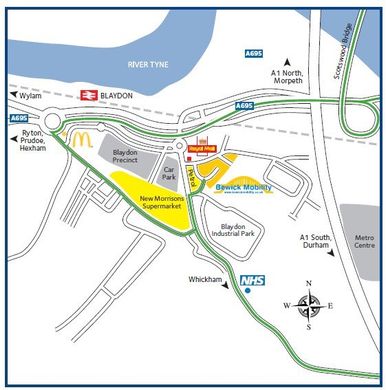

Visit one of our showrooms in Blaydon-on-Tyne and Stockton.